Content:

Tax obligations of foreign persons from the perspective of the Income Tax Act

Taxation of the income of a foreign person who is a tax resident of a contracting state (i.e., a state with which the Slovak Republic has concluded an international double taxation avoidance treaty) and which arises from sources on the territory of the Slovak Republic as defined in Section 16 of Act No. 595/2003 [new Window; only Slovak language] on Income Tax, as amended (hereinafter referred to as the “Income Tax Act”), is governed by the provisions of this treaty and the Income Tax Act.

If the income from sources on the territory of the Slovak Republic is earned by a resident of a country with which the Slovak Republic has not concluded an international treaty, the taxation of their income is exclusively subject to the provisions of the Income Tax Act.

- Income of a foreign dependent contractor performing work on the territory of the Slovak Republic

The income of a foreign dependent contractor performing work on the territory of the Slovak Republic is subject to taxation in the Slovak Republic. This includes, in particular, income from employment, service, civil service, membership or similar relationship, as well as the income of a partner and executive of a limited liability company, a limited partner of a limited partnership company and other. Income from activities that a non-resident of the Slovak Republic carries on board an aircraft or a ship operated by a taxpayer with unlimited tax liability (resident of the Slovak Republic) is also considered dependent contractor income.

When assessing the taxability of a foreign dependent contractor in the Slovak Republic, it is important to distinguish whether the employer is a Slovak or foreign tax entity.

If the employer is a Slovak tax entity (tax resident of the Slovak Republic), the income of a foreign employee is subject to taxation on the territory of the Slovak Republic regardless of the length of their stay on this territory. Their income as a dependent contractor will be taxed through the Slovak employer (income payer) through advance payments.

If the employer is a foreign tax entity (non-resident of the Slovak Republic for tax purposes), it is important to examine the length of the foreign employee’s stay in the Slovak Republic and whether the remuneration paid by the foreign employer is not borne by their permanent business establishment in the Slovak Republic.

If a foreign employee receives income from a foreign tax entity that does not have a permanent business establishment in the Slovak Republic and the time period related to the performance of this activity on our territory does not exceed 183 days in any 12 consecutive months, it is considered tax-exempt income in the Slovak Republic and is subject to taxation in the state of residence of the foreign employee in question. This does not apply to income of an artist, athlete or a circus performer (or income from similar activities) and income from activities performed in a permanent establishment. Tax-exempt income is not to be included in the tax return.

If all the above conditions are not met, income of a foreign dependent contractor is subject to taxation in the Slovak Republic in accordance with the Income Tax Act [new Window; only Slovak language] and the Double Taxation Avoidance Treaty (Article "Dependent Activity" in the case of a Contracting State). This income is taxed through advance payments, whereby the foreign employer is obliged to pay the tax advances (if they are a foreign tax payer in the Slovak Republic), otherwise the employee is obliged to pay the tax advances themselves.

After the end of the taxation period, a foreign employee can settle their dependent contractor income tax obligation in two ways. If they receive taxable income in the Slovak Republic only from dependent contractor activity, they may ask their employer to perform the annual tax clearing. If they not request the annual tax clearing, they shall file a type A tax return if they are so obliged pursuant to the Income Tax Act [new Window; only Slovak language].

- Income of a foreign person from business in the Slovak Republic

The obligations of a foreign person doing business (e.g., selling goods or providing services on the territory of the Slovak Republic) or performing an independent contractor activity in the Slovak Republic depend on whether or not a permanent establishment is founded in the Slovak Republic as a result of this activity.

The conditions for the foundation of a permanent establishment are defined in Section 16 para. 2 of the Income Tax Act [new Window; only Slovak language] and Article 5 of the double taxation avoidance treaty between the Slovak Republic and the relevant state (if one exists).

A foreign person may found the following on the territory of the Slovak Republic:

- a “classic” permanent establishment (permanent place or facility for the performance of activities through which a non-resident of the Slovak Republic performs all or part of their activities in the Slovak Republic),

- a permanent “construction” establishment (a construction site, a place to perform construction and assembly projects),

- a permanent “service” establishment (activity carried out in the Slovak Republic to provide services to taxpayers or persons working for them if the performance of this activity exceeds the specified period), and

- a permanent “agent” establishment (a dependent contractor who acts on behalf of a non-resident of the Slovak Republic and continually or repeatedly negotiates or concludes contracts on their behalf through the power of attorney).

If a foreign person does not have a permanent establishment in the Slovak Republic, the income is not taxable in the Slovak Republic. Such a foreign person is not obliged to register for income tax with the tax administrator in the Slovak Republic.

If a foreign person founds a permanent establishment in the Slovak Republic, the income pertaining to that permanent establishment is taxable in the Slovak Republic under Slovak tax legislation and the foreign person is obliged to settle their tax liability by filing a tax return.

At the same time, the foreign person is obliged to ask the tax administrator to register the permanent establishment by the end of the calendar month following the end of the month in which the permanent establishment was founded.

If a foreign person intends to employ employees (Slovak or foreign) in the Slovak Republic and becomes a foreign payer of dependent contractor income tax, they are obliged to register as a payer of income tax from dependent activity by the end of the calendar month following the month in which the obligation to deduct tax advances arose.

In the above cases, the taxpayer shall use the “Application for Registration, Notification of Changes, Application for Cancellation of Registration” [new Window; only Slovak language] form.

- Foreign person's income from the rental or sale of real estate located in the Slovak Republic

Income from the sale, lease, or other use of real estate located on our territory to a foreign person is taxable in the territory of the Slovak Republic in accordance with the Act No. 595/2003 [new Window; only Slovak language] and in accordance with the double taxation avoidance treaty (in the case of a member state).

Income of a foreign natural person from the sale of real estate may be exempted from income tax if the statutory conditions are met. The exemption depends on the duration of the property ownership, the way in which the property was acquired and whether or not it is included in the taxpayer's commercial property.

A foreign person settles their taxable income from the sale or lease (or other use) of real estate by filing a tax return on income tax.

A foreign natural person who leased real estate (except land) in the territory of the Slovak Republic is obliged to ask the tax administrator to register for income tax by the end of the calendar month after the month in which the real estate was leased. The taxpayer will use the form “Application for Registration, Notification of Changes, Application for Cancellation of Registration” [new Window; only Slovak language].

If a foreign natural person has achieved only income from the sale of real estate in the Slovak Republic, his/her registration duty for income tax is not incurred.

The foreign affiliation of a foreign person to the tax administrator is governed by Section 7 of Act No. 563/2009 Coll. [new Window; only Slovak language] on Tax Administration (Tax Code), as amended.

Tax obligations of foreign persons in terms of Value Added Tax Act

If a foreign person in the Slovak Republic is planning to sell goods or provide services (irrespective of who are his/her customers whether it is Slovak person or other foreign entity), or are planning to acquire the SR goods purchases in another Member State is required prior to the commencement to perform these activities to register for VAT.

The obligation to register as a VAT payer in the Slovak Republic applies to a foreign person even if the defined service is not physically provided in the Slovak Republic, but it is decisive that the client of this service is a Slovak customer or that this service applies to real estate located in the Slovak Republic (e.g. long-term rental of a vehicle to a Slovak citizen, or the service of preparing an expert opinion on a property located in the territory of the Slovak Republic).

In terms of Slovak law these are taxable transactions that are subject to Slovak VAT.

The amount of income (turnover) the foreign person will gain from the aforementioned taxable transactions is not decisive for the fulfillment of the registration duty.

The application for registration as a VAT payer is submitted by a foreign person at the Tax Office Bratislava, Radlinského 37, 817 89 Bratislava.

Note:

VAT Act No. 222/2004 Coll. [new Window; only Slovak language] valid in the Slovak Republic also defines a number of exceptions when the foreign person is not obliged to register as a VAT payer even though he/she carries out the above transactions - e.g. if he/she provides transport services of goods related to the export or import of goods, if he/she supplies goods or services for which the customer is obliged to pay tax in the Slovak Republic (self-taxation), if it delivers goods imported in the Slovak Republic to other Member State and is represented by its tax representative, if it delivers digital services and is identified in another MOSS Member State.

After registering as a VAT payer and assigning a tax identification number, a foreign person applies the 20% or 10% VAT rate to the price of the supplied goods and services subject to Slovak VAT, depending on the type of goods or services, or applies tax exemption.

A VAT tax return is filed by a foreign person within 25 days after the end of the calendar month or calendar quarter, but only if

- they have become obliged to pay tax in the given tax period, or

- they have made an intracommunity supply or export of goods in the Slovak Republic, or

- if he/she has taken part in triangular trade as a 1st customer or if he/she applies a tax deduction.

In defined cases, he/she is also obliged to submit a control statement and summary statement.

In case that the late registration for the period in which he/she was to be payer (from performed taxable transactions subject to Slovak tax), he/she is obliged to settle the tax in a special extraordinary return filed within 60 days of filing is also obliged to pay the relevant tax within a certain period.

After registration as a VAT payer, a foreign person is obliged to deliver the filings to the tax office (tax return, recapitulative statement, audit report and others) only by electronic means.

Tax obligations of foreign persons in terms of the ERP Act

The information relates to an entrepreneur who, on the basis of a trade license, will sell goods or provide a defined service in the territory of the Slovak Republic.

Act No. 289/2008 Coll. [new Window; only Slovak language] on the use of the electronic cash register and on the amendment of Act of the Slovak National Council No. 511/1992 Coll. [new Window; only Slovak language] on Administration of Taxes and Fees and on Changes in the System of Territorial Financial Authorities as amended (hereinafter “Act No. 289/2008 Coll.” [new Window; only Slovak language]).

If a foreign entrepreneur decides to sell goods or provide a legally defined service in the territory of the Slovak Republic and accepts cash sales for these activities at the point of sale, he/she is obliged to register it in the e-cash register client and subsequently hand over the cash receipt to the client e-cash register client. After registering the sales in the cash register of the e-cash register client, the entrepreneur can send the cash receipt to the customer in electronic form and then does not have to print the cash receipt.

The cash register of the e-cash register client means:

- an on-line cash register (hereinafter “OCR”); or

- a virtual cash register (hereinafter referred to as the “VCR”).

The foreign entrepreneur may decide whether to use the OCR or the VCR to record sales. OCR/VCR registration is based on the assignment of the cash register code and, in the case of VCR, also the login data - login and password required to enter the VCR.

Note:

Act No. 289/2008 Coll.” [new Window; only Slovak language]) does not stipulate a different procedure for foreign entrepreneurs who come to the territory of the Slovak Republic to sell goods or provide a defined service only a few times a year, e.g. they come to sell goods occasionally at fairs, markets and the like. If it is a single action of one or more days in which a foreign entrepreneur accepts cash receipts for the sale of goods or the provision of a defined service from customers, it is under an obligation to use an OCR or a VCR. Exemptions from the obligation to use OCR/VCR as defined in Section 3, Para. 2 of the cited Act, once they have been complied with, apply equally to foreign entrepreneurs.

Exceptions include: the sale of live animals other than aquarium fish, exotic birds, exotic animals, snakes, hamsters, guinea pigs and other rodents, the sale of goods as well as the provision of vending machines, the sale of goods on delivery, the sale of goods or the provision of a defined service by a natural person with a severe disability (hereinafter referred to as “SD”); this does not apply if this natural accepts sales of a natural person who is not a natural person with SD.

OCR and VCR registration

A foreign entrepreneur in the application for the assignment of the cash register code of an e-cash register client (OCR/VCR) includes, among other mandatory data, also the data: TIN number (if VAT is not payable) or VAT number (if VAT is payable), which is assigned by the TO in the territory of the Slovak Republic. A foreign entrepreneur must be assigned a Slovak TIN or VAT ID for OCR/VCR purposes.

In order to assign a cash register code (hereinafter referred to as “CRC”), login credentials to the VCR and an initialization package to the OCR, the entrepreneur is obliged to ask the tax office to assign this code. The entrepreneur applies for registration of OCR/VCR electronically via a personal internet zone (electronic filing room on financial administration portal).

In order to be able to electronically apply for a cash register code for an e-cash register client, the foreign entrepreneur is obliged to register and authorize for electronic communication with the financial administration.

Electronic communication relates to a foreign entrepreneur if he/she is a payer of value added tax or is registered in the Commercial Register or has been issued a trade license in the Slovak Republic and has been assigned a Slovak TIN number. However, if a foreign entrepreneur decides to use the ORC, the application for cash register code of the e-cash register client must be submitted only electronically, even if such an entrepreneur is not subject to electronic communication.

The application for the OCR/VCR code assignment is submitted via the structured electronic form “e-cash register client cash register code assignment application” [new Window; only Slovak language] in the personal Internet zone in the “Catalog of Forms” [new Window; only Slovak language] section. The required data in the application must be listed and then sent to the tax office.

In the case of the OCR, after verifying the data stated in the application, the tax office will allocate the CRC to the e-cash register zone on average within 3 working days. Subsequently, the foreign entrepreneur is obliged to download the identification and authentication data from the e-cash register zone and upload it to the cash register.

In the case of a VCR, after verifying the details given in the VCR code assignment application, the tax office of the foreign entrepreneur will register and assign the VCR code. Subsequently, through a security envelope, the foreign entrepreneur will be notified by post with login details (login and password) for access to the VCR. It takes 10 to 14 days to receive your login information after submitting your application to the tax office.

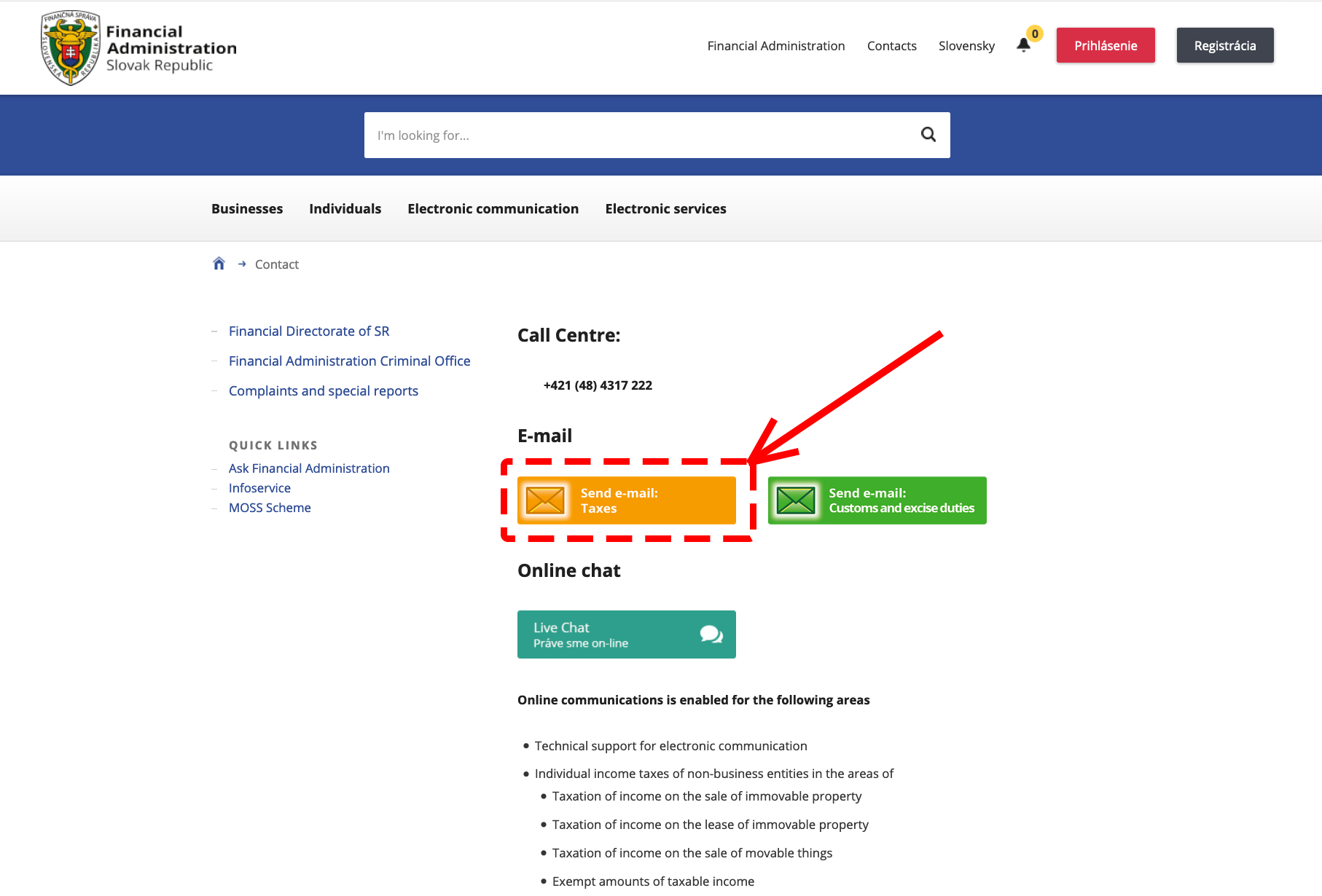

Information on the rights and obligations of foreign taxpayers in matters of taxes and fees and on rights and obligations under a special regulation is available on the Financial Administration Portal.

For more information on the rights and obligations of foreign persons related to tax laws, you can submit a request through the Live Agent application available on the Financial Administration Portal.

More information in this section is divided follows:

More information for individual citizens:

eInvoice Project: Transitioning to a Modern and Efficient Electronic Invoicing System

In cooperation with experts, software companies, accounting system providers and the business sector, the Financial Administration is launching the eInvoice project. The project's goal is to implement electronic invoicing, enabling automated processing and simplifying administrative procedures to increase efficiency. From the second quarter of 2026, companies and entrepreneurs will be able to voluntarily implement eInvoice. This approach is based on a successful European model that has already been adopted by more than twenty EU countries and other states, providing a stable, secure and efficient solution for hundreds of thousands of companies. The introduction of eInvoice in Slovakia is a significant step towards digitising and streamlining business processes. This transition to a modern invoicing method offers many advantages, including reduced administrative burdens, greater security, and increased transparency.

What is an electronic invoice?

What is an electronic invoice?

It is not just a regular PDF file or a digital photograph of a paper invoice. It is a structured XML file containing all the necessary information, such as the invoice number, issue date, item description, amount and recipient details. This format is designed to be machine-readable and processable, thereby eliminating errors caused by manual data entry. For companies and entrepreneurs, eInvoicing enables accurate and efficient communication with the authorities and business partners across the entire European market.

Benefits of eInvoice

Using eInvoice offers many advantages, including:

- Automated invoice processing: - Elimination of manual data entry and transcription errors.

- Time savings and reduced errors: Automatic data processing reduces the risk of mistakes.

- Secure and efficient data transmission: Electronic invoices are securely transmitted through encrypted channels, ensuring their protection.

- Invoicing across the entire EU: eInvoice uses the Peppol system to enable seamless invoicing across EU member states.

- Compliance with Slovak and EU legislation: The system meets the legal requirements for electronic invoicing.

List of certified service providers

This list will be available after 1 January 2026.

Who is required to receive electronic invoices?

All legal entities and entrepreneurs who are taxable persons under Slovak law will be required to receive electronic invoices. This includes, for example:

- self-employed individuals; and

- those with a business licence.

- People practising liberal professions (e.g. lawyers, notaries, architects).

- Independently operating farmers

- Property owners renting out properties

In order to receive electronic invoices, it is necessary to contract a certified service provider, who will ensure that invoices are received correctly and in compliance with legal norms.

Electronic Invoicing via a Certified Service Provider

Electronic invoices will be sent and received via a certified service provider, which ensures the secure and efficient distribution of invoices between senders and recipients. You can use a certified service provider through an accounting programme, website or mobile application. This tool allows you to send and receive invoices, which is necessary to meet legal requirements. Entrepreneurs can choose from several certified service providers on the market that meet all technical and security requirements set by legislation.

What is Peppol?

Peppol is a secure European network for the electronic exchange of business documents between companies. It operates like a digital mail system for invoices, orders and other documents.

The Peppol eDelivery Network: A secure and reliable network for the real-time delivery of electronic documents with guaranteed delivery.

Peppol BIS Format: A standardised invoice format based on the European standard EN 16931, ensuring compatibility across Europe.

European integration: Peppol enables connection with 21 countries across Europe, allowing seamless electronic invoicing across borders.

European integration: Peppol enables connection with 21 countries across Europe, allowing seamless electronic invoicing across borders.

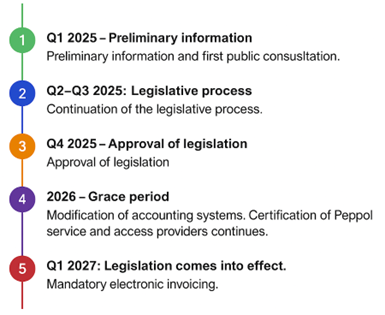

Important Dates

- January 1, 2026: The validity of the electronic invoicing legislation

- January 1, 2027: The effectiveness of the electronic invoicing legislation

Implementation Schedule

Approved version of the law

The law will be published.

Information for certified service providers/intermediaries

Accreditation conditions

- OpenPeppol certification for e-invoicing and e-reporting: a certified service provider must present a valid OpenPeppol certificate.

- Company headquarters in the EU: a certified service provider must prove that their headquarters or place of business is located in an EU member state.

- Integrity: the person and their statutory body or a member of the statutory body must be without a criminal record.

Accreditation scheme in Slovakia

Documents will be published.

Application for Accreditation of a Service Provider

The document will be published.

Start of accreditation for certified service providers

A person can provide a delivery service in Slovakia as a certified service provider if they are registered in the registry. From 1 January 2026, the registry will be managed by the Financial Administration on its website.

Certified service providers can already apply to OpenPeppol for membership, certification of their software and issuance of the OpenPeppol certificate.

Further information can be found on the 'The Future Is Open' – OpenPeppol website

Readability of Invoices

In accordance with § 76a, paragraph 2c of the VAT Act, readability of invoices in XML BIS format must be ensured. This format is mandatory for all electronic invoices and must enable clear and comprehensible display of data.

Log security

Certified service providers must store logs of invoice delivery and receipt for at least six months. This step is necessary to ensure transparency and enable checks if needed.

Rights and obligations of certified service providers

Basic duties:Compliance with Peppol standards, providing user support and maintaining activity logs and incident reports.

Important: the certified provider must obtain authorisation from the user via an application provided by the Financial Administration of the Slovak Republic. Only then can the customer be registered in the Central Address System (SMP – Service Metadata Publisher). Failure to comply with this obligation will result in sanctions as described below.

Sanctions:

Failure to comply with the conditions will result in non-monetary sanctions, such as publication of status, suspension of access or withdrawal of authorisation.

Fees and costs:

Each party bears their own costs. Certified service providers set their own prices for end users.

For intermediaries

Certified service providers can offer their services either directly or through intermediaries. Intermediaries use the services of certified service providers and sell them on their behalf.

Information for accounting software providers/portals

EN 16931: European standard for electronic invoices

This standardised format for electronic invoices in the EU defines the basic elements and structure of invoices to ensure interoperability between different systems.

European standard for electronic invoices

Peppol BIS Format

A standardised format for electronic invoices based on UBL 2.1 that defines the structure, rules and limitations for electronic invoices on the Peppol network, in compliance with the European standard EN 16931.

Official Peppol BIS documentation

Implementation Guide

Comprehensive guide to implementing the Peppol BIS format, including the history of standards, an explanation of the structure of the documentation, how to read the specifications, how to validate documents, and practical steps for implementation.

Implementation Guide

Testing materials

Detailed manual and test cases for implementing Peppol BIS in Slovakia, created in cooperation with partners.

Test scenarios:

The document will be published

Validation rules:

The document will be published

Information for business owners:

How to get started:

- Contact the manufacturer of your accounting software. Check that they are ready to create and receive invoices in Peppol BIS format.

- Choose a certified service provider for the Peppol network (intermediary or a directly certified service provider).

- Testing and launch. Test sending and receiving invoices before the full launch.

List of certified delivery service providers

This list will be available after 1 January 2026.

Information for accountants:

Demo:

Try out the fully integrated accounting software (mock-up), which is connected to the real Peppol network (test network).

Accounting software demo

Information for public administration:

How to get started:

- Contact the manufacturer of your financial software. Verify that you are ready to create and receive invoices in Peppol BIS format.

- Submit a public procurement request to a certified service provider for the Peppol network (intermediary or a directly certified service provider).

- Testing and launch. Test sending and receiving invoices before the full launch.

List of certified delivery service providers

This list will be available after 1 January 2026.

Frequently Asked Questions

eInvoice FAQs

Webinar recordings and presentations